The New US Import Legislation and Its Effect on the American Supply Chain

Tensions between the US and China are coming to a head as the human rights abuses in the Xinjiang region, a strong manufacturing hub, are being brought to light. Legislation regarding the import of goods made in this region are set to address the concerns of the American people are slated to take effect at the end of June 2022.

Uyghur Forced Lour Prevention Act, EO

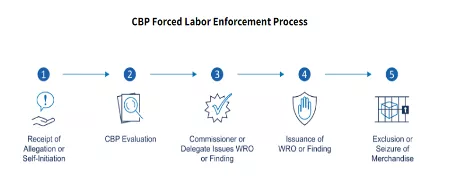

Firstly, The Uyghur Forced Labor Prevention Act (UFLPA) was signed into law by President Biden on December 23, 2021 and establishes a rebuttable presumption that the importation of any goods, wares, articles, and merchandise mined, produced, or manufactured wholly or in part in the Xinjiang Uyghur Autonomous Region of the People’s Republic of China, or produced by certain entities, is prohibited by Section 307 of the Tariff Act of 1930 and that such goods, wares, articles, and merchandise are not entitled to entry to the United States. The presumption applies unless the Commissioner of U.S. Customs and Border Protection (CBP) determines that the importer of record has complied with specified conditions and, by clear and convincing evidence, that the goods, wares, articles, or merchandise were not produced using forced labour. This act comes into force on 21st June 2022.

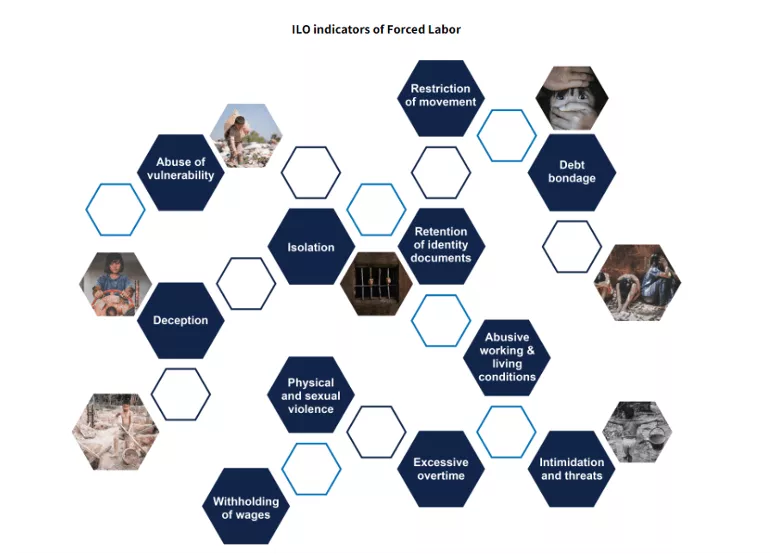

Since 2017, Chinese authorities have committed crimes against humanity against Uyghurs and other Turkic Muslims in the northwest Xinjiang region, detaining as many as one million people and subjecting detainees and others to forced labour inside and outside Xinjiang. The new law creates a presumption that goods made in whole or in part in Xinjiang or produced by entities in China linked to forced labor, are not eligible to be imported into the United States as a primary principle of the act itself.

The Proposed Legislation

Customs and Border Protection (CBP) has released importer guidance to assist the trade community in preparing for the implementation of the UFLPA, which can be found by following this link: Uyghur Forced Labor Prevention Act U.S. Customs and Border Protection Operational Guidance for Importers (cbp.gov)

Please be aware that this is CBP’s importer guidance, which provides transparency to CBP’s operational approach, and not the Forced Labour Enforcement Task Force’s Strategy, which will provide additional importer guidance, required by the UFLPA.

Accordingly, Shipments imported on or after June 21, 2022, that are subject to the UFLPA, which previously would have been subject to a XUAR WRO, will be processed under UFLPA procedures, and detained, excluded, or seized.

Key Points:

Therefore, please be aware that the guidance also clarifies that companies importing products from outside China should still investigate their full supply chain given the risk that goods were produced with forced labour in China before being transferred to third countries. Credible research has linked a wide range of products imported into the US to forced labor in China, and Xinjiang specifically, such as the cotton in major clothing brands and the polysilicon in solar panels.

The Human rights organisation Watch has stated that:

“For companies sourcing from Xinjiang, however, providing “clear and convincing evidence” is a near impossible bar to clear. The extent of Chinese government surveillance and threats to workers and auditors currently prevents companies from meaningfully evaluating the use of forced labor at factories or other facilities in Xinjiang. Even elsewhere in China, the arrests of labor activists, a prohibition on independent trade unions, government surveillance, and the Chinese government’s anti-sanctions laws pose serious obstacles to identifying and remediating the risk of forced labor and other human rights abuses. Companies with operations, suppliers, or sub-suppliers in Xinjiang should instead relocate their facilities or supply chains elsewhere”.

A report was issued to the US senate June 17, 2022 outlining the Homeland Departments strategy in respect of the wider prevention of the Importation of Goods Mined, Produced, or Manufactured with Forced Labor in the People’s Republic of China (Strategy to Prevent the Importation of Good Mined, Produced, or Manufactured with Forced Labor in the People's Republic of China (dhs.gov)). This strategy covers;

Input from various public and private-sector stakeholders. It incorporates significant contributions from FLETF members and observers and takes into account public comments received through the FLETF’s Federal Register request for information and the UFLPA public hearing.

UFLPA and Strategy:

-

A comprehensive assessment of the risk of importing goods mined, produced, or manufactured, wholly or in part, with forced labour in the PRC;

-

An evaluation and description of forced-labour schemes, UFLPA-required lists (including the UFLPA Entity List), UFLPA-required plans, and high priority sectors for enforcement;

-

Recommendations for efforts, initiatives, tools, and technologies to accurately identify and trace affected goods;

-

A description of how U.S. Customs and Border Protection (CBP) plans to enhance its use of legal authorities and tools to prevent entry of goods at U.S. ports in violation of 19 U.S.C. § 1307;

-

A description of additional resources necessary to ensure no goods made with forced labour enter U.S. ports;

-

Guidance to importers; and

-

A plan to coordinate and collaborate with appropriate nongovernmental organizations (NGOs) and private-sector entities.

The expectation being that there will be further legislation in this space.

Ocean Shipping Reform Act of 2022 (OSRA22)

Secondly, on June 16, 2022 the “Ocean Shipping Reform Act of 2022 (OSRA22)” came into Law. In short, this Act delivers the following;

-

Expands safeguards to combat retaliation and deter unfair business practices;

-

Clarifies prohibited carrier practices pertaining to detention and demurrage charges and vessel space accommodation;

-

Establishes a shipping exchange registry through the FMC;

-

Expands penalty authority to include refund of charges;

-

Increases efficiency of the detention and demurrage complaint process.

-

Authorizes appropriations for the Federal Maritime Commission (FMC) for fiscal years 2022 through 2025;

-

Requires the FMC to issue rules related to certain fee assessments, prohibited practices, and establishment of a shipping registry; and

-

Authorizes the FMC under certain circumstances to issue an emergency order requiring common carriers to share information directly with shippers and rail and motor carriers.

As per the US Congress, “This bill revises provisions related to ocean shipping policies and is designed to support the growth and development of U.S. exports and promote reciprocal trade in the foreign commerce of the United States.”

The OSRA22 termed as “the first significant reform of shipping laws in 24 years” was based on the Ocean Shipping Reform Act of 2021, H.R. 4996 and was passed by the House on the 13th of June 2022 and subsequently signed by The President of the United States (POTUS) on 16th June 2022.

In what is seen by many including the World Shipping Council (WSC) as a “mischaracterization of the industry”, President Biden repeated some of his comments about the situation with the Ocean Carriers particularly the ocean carrier members of the Global Shipping Alliances.

At the heart of this law is to tackle the price escalation as a consequence of the nine major shipping companies consolidated into three alliances that control the vast majority of ocean shipping in the world and each of these nine are all non US/foreign-owned.

Biden was quoted as stating that: “During the pandemic, these carriers increased their prices by as much as 1000% while families and businesses struggled around the world. These carriers made $190 billion in profit in 2021, 7 times higher than the year before and they raked in the profits, and the costs got passed on as you might guess, directly to the consumers sticking it to American families and businesses. These foreign-owned carriers have also been refusing to carry American-made products back to Asia”. An article on Forbes said “The fastest growth category of e-commerce sales over the past two years were furniture, building materials, and electronics which cumulatively grew more than 200% since 2019. Food and beverage e-commerce grew 170%, representing 9.6% of all grocery sales in 2021 according to eMarketer. Apparel was one of the few categories of e-commerce to grow slower than the industry average at 39%.”

On one side, while COVID-19 affected labour due to restricted movement by people, creating labour shortages, on the other side, a combination of the ease of online shopping, panic buying, continued work from home and the necessity created by COVID-19 led to a boom in container shipping volumes across the world, choking ports and terminals, warehouses and container depots..

The US West Coast ports, in particular, bore the brunt with up to 100+ ships waiting outside the ports of Los Angeles and Long Beach for a berth to offload the goods that ensued from the surge in demand brought about the pandemic. The pandemic and the resultant boom in container volumes has exposed the vulnerabilities faced by supply chains and their susceptibility to disruptions.

Shipping and Freight Resource

The transport industry through the “Shipping and Freight Resource” has openly stated that the disruptions are mainly of an operational nature in the US due the following factors:

-

Operational inefficiencies in US ports – citing the need for automation of cranes, labor practices and other factors.

-

Chassis operations – a unique to the USA compared to many other countries around the world., where ocean carriers still hold a massive sway over how the chassis is used because they provide door to door contracts (carrier haulage) restricting the use of chassis for only specific line boxes. Thereby missing interoperability among chassis pools and carriers which is hampering the smooth movement of containers in and out of ports and terminals which in turn is hampering port operations.

-

Alleged price gouging – effectively a crackdown on monopolistic foreign-owned shipping companies

-

Retaliation –The OSRA22 has amended Section 41102 of title 46, United States Code, to read “A common carrier, marine terminal operator, or ocean transportation intermediary, acting alone or in conjunction with any other person, directly or indirectly, may not—

-

retaliate against a shipper, an agent of a shipper, an ocean transportation intermediary, or a motor carrier by refusing, or threatening to refuse, an otherwise-available cargo space accommodation; or

-

resort to any other unfair or unjustly discriminatory action for—

-

the reason that a shipper, an agent of a shipper, an ocean transportation intermediary, or motor carrier has

-

(i) patronised another carrier; or

-

(ii) filed a complaint against the common carrier, marine terminal operator, or ocean transportation intermediary; or

-

-

any other reason

-

-

-

Rejection of cargo – The OSRA2022 also adds a new provision that states that ocean carriers shall not “unreasonably refuse cargo space accommodations when available, or resort to other unfair or unjustly discriminatory methods clearly to address informal complaints from US exporters to the FMC about lack of space and equipment for exports offered by carriers”.

-

Demurrage and Detention – One of the key areas where the OSRA22 has addressed the concerns of the market is in terms of the invoicing of demurrage and detention by ocean carriers, as well as minimum information as determined by the Commission:

Global Supply Chain Response

The intricacies involved in global supply chains and how it addresses the bottlenecks and disruptions faced by the consumers and whether the OSRA22 has and will succeed in addressing all the problems faced, is up for debate and will only be evaluated with the passing of time. However, it has been seen that the FMC seems to be taking some visible action against errant ocean carriers with Wan Hai and Hapag Lloyd paying penalties after the lines were found to have violated the law by knowingly and wilfully failing to establish, observe, and enforce just and reasonable regulations and practices relating to or connected with receiving, handling, storing or delivery property, by unreasonably refusing to waive detention charges, in violation of 46 USC 41102(c).

Accordingly, legal and compliance developments in this space, with more on the horizon, procurement and supply chain professionals need to know what to focus on, and what they should be doing. Focus has turned to some specific areas such as the Semiconductor and Advanced Packaging Supply Chain where legal and compliance considerations for companies operating in this sector will need a clear understanding of the implications in terms of tax, trade, and foreign investment. The same being true for large capacity batteries, Critical Minerals and Strategic Materials, pharmaceuticals, and active ingredients to produce pharmaceuticals.

What is very clear is that the critical focus on supply chains and their strategic role in the vitality of an economy has been fully recognised and placed front and centre of the Administrative plan to an extent that has perhaps not been seen for a very long time. This signals the need for procurement and supply chain professionals to work closer and more collaboratively with their legal counsels to a new and higher level going forward to ensure not just compliance but to develop the opportunities and competitive advantage that can flow from such strategic intervention.

Resources:

- Uyghur Forced Labour Act:

- The U.S. Department of State’s Responsible Sourcing Tool: Responsible Sourcing Tool

- The U.S. Department of State’s Trafficking in Persons Report: 2021 Trafficking in Persons Report - United States Department of State

- The U.S. Department of Labor’s Comply Chain: Comply Chain - United States Deparment of Labor (dol.gov)

- The U.S. Department of Labor’s Better Trade Tool: Better Trade Tool | U.S. Department of Labor (dol.gov)

- Federal Acquisition Regulations: FAR | Acquisition.GOV

- National Action Plan on Responsible Business Conduct: Responsible Business Conduct National Action Plan - United States Department of State

- The U.S. Customs and Border Protection’s Forced Labor website resources: Forced Labor | U.S. Customs and Border Protection (cbp.gov)

Acknowledgments:

Special acknowledgement for the help and support of Professor Christopher L. Atkinson, Ph.D. from the University of West Florida where he specialises in Administration and Law.

Additional Reading: Insights on American Legislation Effecting Supply Chain Management